|

||

2021-2022 BUDGET UPDATEJune 30th is the constitutionally required deadline for the legislature to approve a state budget for Fiscal Year 2021-2022, and I am pleased that we were able to reach a consensus and pass a budget on Friday. As promised in my Session Wrap-Up sent that night, the purpose of this e-news is to provide you with highlights from this year’s budget.

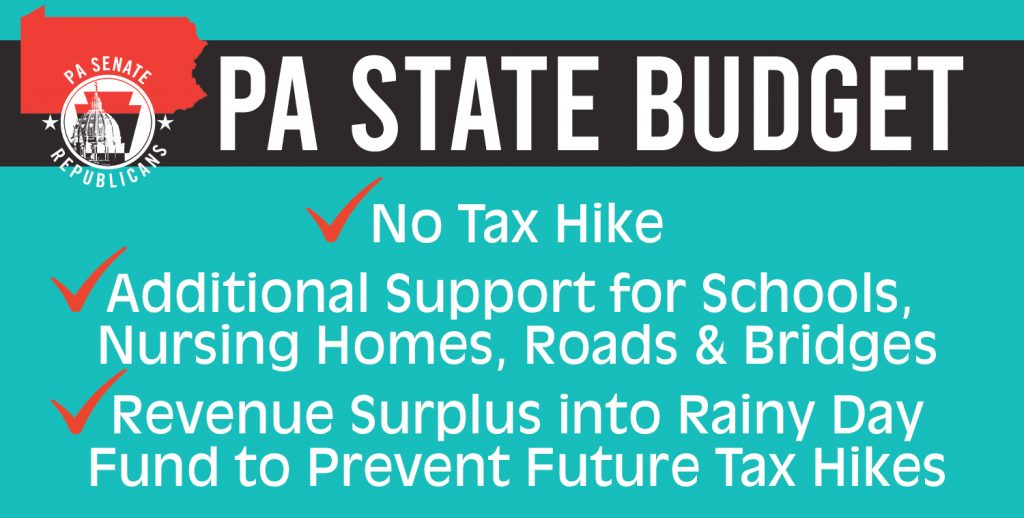

OVERVIEW The Senate approved a $40.8 billion state budget for Fiscal Year 2021-2022, which represents a $1 billion, or 2.6%, increase over last year’s budget. This fiscally responsible spending plan supports Pennsylvania’s economic recovery from the COVID-19 pandemic, while providing a financial safety net for the future. Most notably, it does not include any of the tax increases proposed by the governor in February — including a 46% Personal Income Tax hike. Fortunately, Pennsylvania is on pace to end the current fiscal year with $2.5 billion in surplus revenue – in comparison to the revenue projections that had been made as Pennsylvania was coping with the financial devastation caused by the global pandemic and the governor’s business closure orders. Despite a significant rebound in revenues and the availability of federal stimulus funds to help balance the budget, Pennsylvania’s mandated spending growth still outpaces our revenue growth and the Commonwealth cannot depend on continued federal funding. This budget provides a three-tier approach to create a strong financial safety net for coming years:

EDUCATION

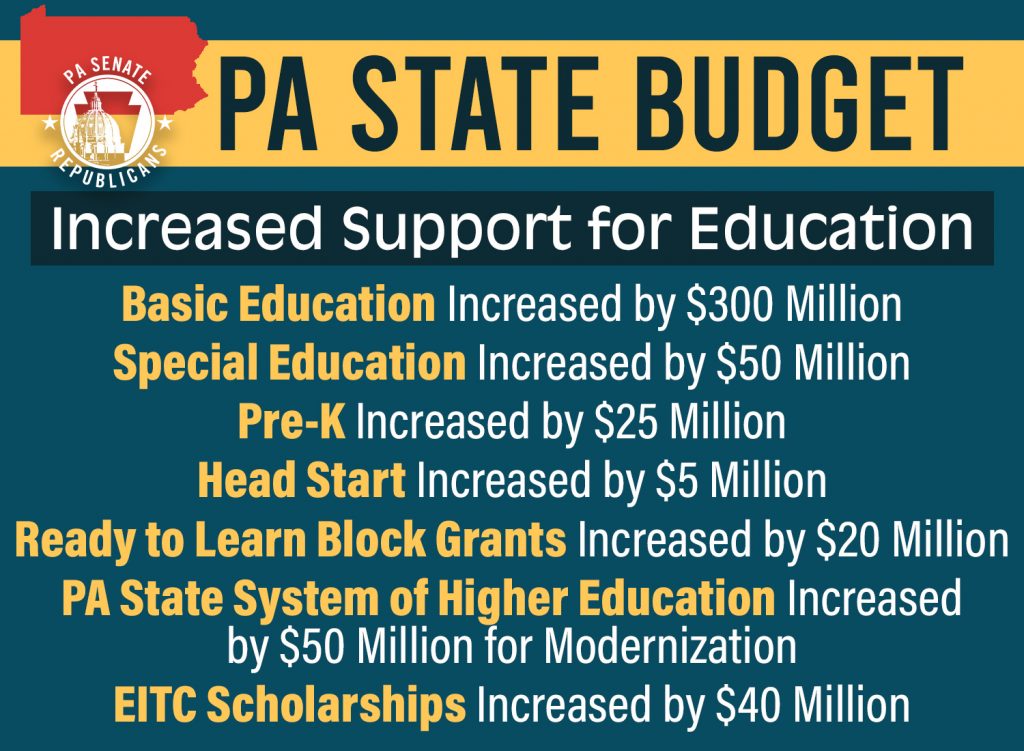

Education combined makes up the second highest segment of state spending, behind only Human Services, and of the 15 largest appropriations in the budget, six of them are education-related. Basic Education is the largest appropriation at $7 billion, School Employees’ Retirement comes in fourth at $2.7 billion, Special Education is eighth at $1.2 billion, Pupil Transportation is 13th at $597 million, the State System of Higher Education is 14th with $477 million and Early Intervention (Preschool Program) rounds out the list at 15th with $336 million. I point this out because so often, claims are made that the state is underfunding our public schools. But these numbers speak differently. State funding for schools has actually increased 68% since 1990 and 28.8% since 2012. This year’s budget marks the largest investment in education, especially important following the impact COVID-19 has had. Many schools within the 31st Senatorial District will receive between 3% and 7% increases. Of the federal funding, $500 million will be dedicated to ensuring schools can reopen, maintain operations, and address student needs resulting from the pandemic. I am also pleased with the increase of $40 million for the Educational Improvement Tax Credit (EITC) program for students that seek a different learning environment outside of their home school district. OTHER KEY LINE-ITEMS

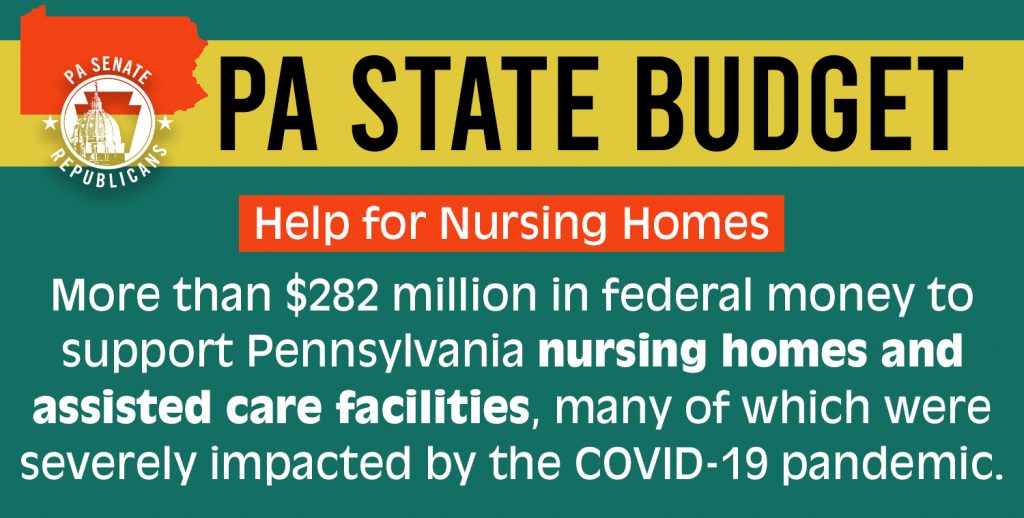

Long-Term Care

Intellectual Disabilities – Community Waiver

Transportation

Miscellaneous

SUMMARYOverall, the state budget for Fiscal Year 2021-2022 represents an increase in spending but responsibly uses a portion of the federal stimulus money to provide for that increase, while putting some of those dollars, along with expected state revenue surplus, into savings. The legislature has implemented basic financial responsibility practices, as we all would teach our children to do or use ourselves for our family budgets, particularly following unstable and unpredictable times. A windfall of money is not to be spent all at once. And after years of budget shortfalls being filled through the borrowing of money from dedicated funds, we are now in a position to not only pay back borrowed money, which this year’s budget does do, but also earmark surplus funds for future budgets. |

||

|

||

2024 © Senate of Pennsylvania | https://senatorregan.com | Privacy Policy |